33+ refinance mortgage tax deduction

When you take a deduction you lower the amount of money on which you must pay taxes. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The standard deduction for married.

. Web home mortgage deduction mortgage interest deduction limit refinance refinancing mortgage tax deductions limits mortgage interest deduction refinance changes. Web A deduction is a cost that reduces your tax liability. Looking For a Loan Refinance.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. For taxpayers who use. 25900 for married taxpayers filing jointly up from 25100 in 2021.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Single or married filing separately 12550 Married filing jointly or qualifying widow er. Ad Compare Refinance Rates Lenders To Find The Perfect Mortgage For You. Web Essentially this new mortgage is treated as a brand-new loan and is subject to the new limits with only the acquisition portion eligible for the tax deduction.

Our Trusted Reviews Help You Make A More Informed Refi Decision. Web As of 2022 taxpayers can claim the following standard deductions. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Rent you receive from tenants is taxable income and it has to be reported. However higher limitations 1 million 500000 if married.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

From 2017 onward homeowners could only deduct interest on up to. Web Basic income information including amounts of your income. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Put Your Equity To Work. Web After the tax-reform package became law the mortgage interest deduction limit was lowered. Check Out Our Rates Comparison Chart Before You Decide.

Homeowners who bought houses before. Ad Shortening your term could save you money over the life of your loan. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Taxes Can Be Complex.

Homeowners who are married but filing. Taxes Can Be Complex. 12950 for single taxpayers.

But the money you spend to. Dont Wait For A Stimulus From Congress Refinance Instead. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web For 2021 tax returns the government has raised the standard deduction to. Web The rules are different if you refinance the mortgage on a rental property.

Web 33 mortgage refinance tax deduction Rabu 22 Februari 2023 Edit. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Mortgage Interest Deduction How It Calculate Tax Savings

Betterment Resources Original Content By Financial Experts App

Foreclosure Help Moshes Law

Mortgage Interest Deduction How It Calculate Tax Savings

What Is Mortgage Interest Deduction Zillow

Annual Report 2003 2004

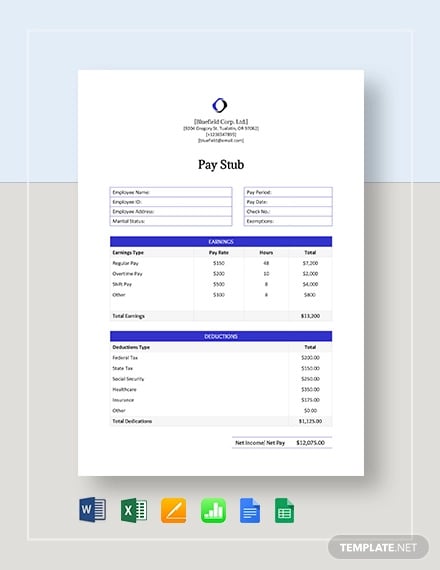

33 Stub Templates In Pdf

Does Refinancing Affect Your Taxes Assurance Financial

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

Tax Deductions For Interest On A Mortgage Refinancing

Culpeper Times March 16th 2017 By Insidenova Issuu

Tax Implications Of Refinancing Your Homes Pkf Mueller

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

American Economic Association

:max_bytes(150000):strip_icc()/GettyImages-1282179800-9e2c7156becb49d892d01207b646e7ce.jpg)

Tax Deductions For Interest On A Mortgage Refinancing

Xp0npdvdshyj7m